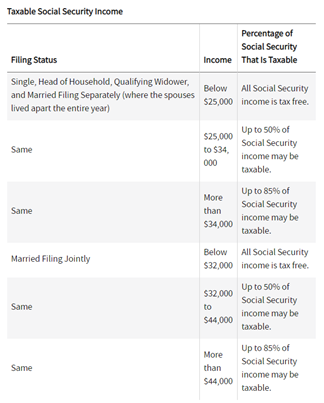

Retirees face multiple income traps, and many retired taxpayers will see a portion of their Social Security income make its way onto the taxable income line of their 1040s.

Retirees face multiple income traps, and many retired taxpayers will see a portion of their Social Security income make its way onto the taxable income line of their 1040s.

Those who convert their traditional IRAs to Roth IRAs are especially susceptible to this situation. If you happen to exceed the funding limit, the extra income pushes you beyond the income threshold level requiring you to pay tax on Social Security income that you thought was tax-free.

Additionally, a shift in marital status can place you in a higher tax bracket, even because of the death of a spouse.

Lower- and middle-income retirees get hit by the so-called tax torpedo, as rising income causes their Social Security benefits to be taxed.

Lower- and middle-income retirees get hit by the so-called tax torpedo, as rising income causes their Social Security benefits to be taxed.

After a one-year hiatus, RMDs will be back when filing 2021 taxes, increasing your income. Thus, it would pay to start thinking about avoiding future RMD-induced tax triggers now.

Options for Lowering Your Social Security Taxes

- Seniors can take steps to avoid or minimize tax traps. These include delaying spending from one year to the next and judiciously tapping after-tax accounts to lower taxable income.

- Another option would be taking RMDs as a qualified charitable distribution if you don’t need the income. That way, it won’t trigger higher taxes or higher future Medicare premiums.

- Retirees in their 60s often pay little or no taxes before they begin taking Social Security. Many are living off after-tax savings, Roth IRA accounts, or inherited money. The standard advice is to spend this money before tapping tax-deferred accounts. Then, take advantage of their low tax bracket to convert money in tax-deferred accounts to Roth IRAs.

- Generally, annuities become taxable income when they’re taken as distributions depending on the account type. Virtually any investor who isn’t spending all the interest paid from a CD or other taxable instrument can benefit from moving at least a portion of his or her assets into a tax-deferred investment or account.

- Another possible remedy could be to simply work a little less, especially if you’re at or near the threshold of having your benefits taxed.

There are many rules concerning the taxation of income during retirement, and it’s crucial to know your situation to find ways to minimize the impact. As financial professionals, we can help you plan now to protect the retirement nest egg you have worked so hard to build. Call us today at (540) 720-5656, and let’s find some options that will work for you.

Megan Jones joined the ILG Financial team in 2020 as marketing director. Megan and her husband live in Fredericksburg, VA with their German Short Haired Pointer, Gus. Megan is a graduate of Longwood University and holds a degree in communications. Megan is the oldest of Dave Lopez’s three children and not only enjoys working alongside her father, but also with her cousin, Chase, who joined the ILG Financial team in 2020 as an advisor. Megan is also a fully licensed Life, Health, and Annuity agent. When not at work, Megan enjoys sitting on the back porch with family and friends enjoying food and music.

Megan Jones joined the ILG Financial team in 2020 as marketing director. Megan and her husband live in Fredericksburg, VA with their German Short Haired Pointer, Gus. Megan is a graduate of Longwood University and holds a degree in communications. Megan is the oldest of Dave Lopez’s three children and not only enjoys working alongside her father, but also with her cousin, Chase, who joined the ILG Financial team in 2020 as an advisor. Megan is also a fully licensed Life, Health, and Annuity agent. When not at work, Megan enjoys sitting on the back porch with family and friends enjoying food and music. Amy Anderson joined the ILG Financial team in 2023 as the client relations coordinator. Her responsibilities include scheduling of appointments, annual check-up notifications, and annuity and required minimum distribution assistance. She is a graduate of Harding University with a degree in Computer Information Systems. Amy and her husband have two children and she enjoys reading, crocheting, music and spending time with her family.

Amy Anderson joined the ILG Financial team in 2023 as the client relations coordinator. Her responsibilities include scheduling of appointments, annual check-up notifications, and annuity and required minimum distribution assistance. She is a graduate of Harding University with a degree in Computer Information Systems. Amy and her husband have two children and she enjoys reading, crocheting, music and spending time with her family. Terri Center joined the ILG Financial team in 2019 as client services manager. She handles client records, application processing, and gathering information to provide a professional and friendly experience with all of our clients. Terri is a graduate of Oakland University. She is married and has two children. She enjoys hiking, family time, and puzzle challenging video games. She also likes to share her creativity in her canvas paintings and sewing projects.

Terri Center joined the ILG Financial team in 2019 as client services manager. She handles client records, application processing, and gathering information to provide a professional and friendly experience with all of our clients. Terri is a graduate of Oakland University. She is married and has two children. She enjoys hiking, family time, and puzzle challenging video games. She also likes to share her creativity in her canvas paintings and sewing projects. Jessica Carson joined the ILG Financial team in 2018 as an agent. Jessica and her husband have four children, two dogs, 3 barn cats, 5 chickens, and three parakeets. She indeed loves her children and pets! When not at work, Jessica enjoys playing the piano and cello as well as traveling and spending time outside with her family, hiking, fishing, and boating.

Jessica Carson joined the ILG Financial team in 2018 as an agent. Jessica and her husband have four children, two dogs, 3 barn cats, 5 chickens, and three parakeets. She indeed loves her children and pets! When not at work, Jessica enjoys playing the piano and cello as well as traveling and spending time outside with her family, hiking, fishing, and boating. Chase Lopez joined the ILG Financial team in 2020 as an advisor. Chase is a 2016 James Madison University graduate with a degree in management. Chase has been trained under the tutelage of Dave Lopez, who is not only the founder and managing member of ILG Financial, but also is Chase’s uncle and godfather. He also enjoys working alongside his cousin, Megan, who is Dave’s daughter.

Chase Lopez joined the ILG Financial team in 2020 as an advisor. Chase is a 2016 James Madison University graduate with a degree in management. Chase has been trained under the tutelage of Dave Lopez, who is not only the founder and managing member of ILG Financial, but also is Chase’s uncle and godfather. He also enjoys working alongside his cousin, Megan, who is Dave’s daughter.