Article originally published by Forbes.com.

Written by Lynn Keck

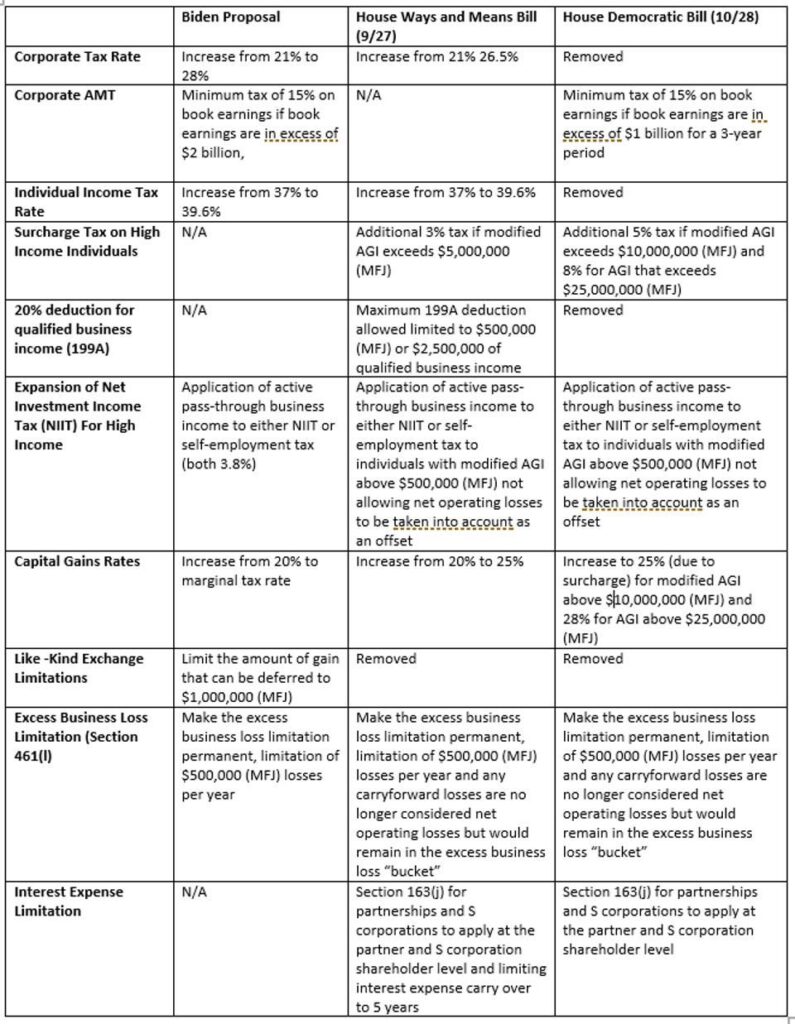

If you’ve had your head buried in the sand, or just decided you were not going to follow all the potential federal tax law changes, you’ve chosen wisely. Between the Biden Green Book proposal, the House Ways and Means Committee proposal, and the most recent Budget Reconciliation Bill released by the House Democrats this past week, the potential tax law changes have been all over the board. The deviations between the proposals seem to indicate there is still enough discontent amongst the Democratic party in D.C. to require significant changes. Unfortunately, when you follow the money, the picture starts to reveal that the taxpayers bearing the burden for the revenue are disproportionately pass-through entity owners, and not the large multinational companies and estates as many believed. The best way to understand the most recent tax proposals is to review the progression of the changes and follow the money train.

If you’ve had your head buried in the sand, or just decided you were not going to follow all the potential federal tax law changes, you’ve chosen wisely. Between the Biden Green Book proposal, the House Ways and Means Committee proposal, and the most recent Budget Reconciliation Bill released by the House Democrats this past week, the potential tax law changes have been all over the board. The deviations between the proposals seem to indicate there is still enough discontent amongst the Democratic party in D.C. to require significant changes. Unfortunately, when you follow the money, the picture starts to reveal that the taxpayers bearing the burden for the revenue are disproportionately pass-through entity owners, and not the large multinational companies and estates as many believed. The best way to understand the most recent tax proposals is to review the progression of the changes and follow the money train.

A sigh of relief was felt by investors, as the increase in capital gains from 20% to 25% does not appear in the most recent proposal for married filing joint taxpayers earning taxable income over $450,000, or $400,000 of taxable income for single filers. However, there still will be an increase to 25% and 28% for individual taxpayers with AGI over $10,000,000 and $25,000,000 respectively due to the surcharge tax.

Click here to read the rest of this article on Forbes.

Megan Jones joined the ILG Financial team in 2020 as marketing director. Megan and her husband live in Fredericksburg, VA with their German Short Haired Pointer, Gus. Megan is a graduate of Longwood University and holds a degree in communications. Megan is the oldest of Dave Lopez’s three children and not only enjoys working alongside her father, but also with her cousin, Chase, who joined the ILG Financial team in 2020 as an advisor. Megan is also a fully licensed Life, Health, and Annuity agent. When not at work, Megan enjoys sitting on the back porch with family and friends enjoying food and music.

Megan Jones joined the ILG Financial team in 2020 as marketing director. Megan and her husband live in Fredericksburg, VA with their German Short Haired Pointer, Gus. Megan is a graduate of Longwood University and holds a degree in communications. Megan is the oldest of Dave Lopez’s three children and not only enjoys working alongside her father, but also with her cousin, Chase, who joined the ILG Financial team in 2020 as an advisor. Megan is also a fully licensed Life, Health, and Annuity agent. When not at work, Megan enjoys sitting on the back porch with family and friends enjoying food and music. Amy Anderson joined the ILG Financial team in 2023 as the client relations coordinator. Her responsibilities include scheduling of appointments, annual check-up notifications, and annuity and required minimum distribution assistance. She is a graduate of Harding University with a degree in Computer Information Systems. Amy and her husband have two children and she enjoys reading, crocheting, music and spending time with her family.

Amy Anderson joined the ILG Financial team in 2023 as the client relations coordinator. Her responsibilities include scheduling of appointments, annual check-up notifications, and annuity and required minimum distribution assistance. She is a graduate of Harding University with a degree in Computer Information Systems. Amy and her husband have two children and she enjoys reading, crocheting, music and spending time with her family. Terri Center joined the ILG Financial team in 2019 as client services manager. She handles client records, application processing, and gathering information to provide a professional and friendly experience with all of our clients. Terri is a graduate of Oakland University. She is married and has two children. She enjoys hiking, family time, and puzzle challenging video games. She also likes to share her creativity in her canvas paintings and sewing projects.

Terri Center joined the ILG Financial team in 2019 as client services manager. She handles client records, application processing, and gathering information to provide a professional and friendly experience with all of our clients. Terri is a graduate of Oakland University. She is married and has two children. She enjoys hiking, family time, and puzzle challenging video games. She also likes to share her creativity in her canvas paintings and sewing projects. Jessica Carson joined the ILG Financial team in 2018 as an agent. Jessica and her husband have four children, two dogs, 3 barn cats, 5 chickens, and three parakeets. She indeed loves her children and pets! When not at work, Jessica enjoys playing the piano and cello as well as traveling and spending time outside with her family, hiking, fishing, and boating.

Jessica Carson joined the ILG Financial team in 2018 as an agent. Jessica and her husband have four children, two dogs, 3 barn cats, 5 chickens, and three parakeets. She indeed loves her children and pets! When not at work, Jessica enjoys playing the piano and cello as well as traveling and spending time outside with her family, hiking, fishing, and boating. Chase Lopez joined the ILG Financial team in 2020 as an advisor. Chase is a 2016 James Madison University graduate with a degree in management. Chase has been trained under the tutelage of Dave Lopez, who is not only the founder and managing member of ILG Financial, but also is Chase’s uncle and godfather. He also enjoys working alongside his cousin, Megan, who is Dave’s daughter.

Chase Lopez joined the ILG Financial team in 2020 as an advisor. Chase is a 2016 James Madison University graduate with a degree in management. Chase has been trained under the tutelage of Dave Lopez, who is not only the founder and managing member of ILG Financial, but also is Chase’s uncle and godfather. He also enjoys working alongside his cousin, Megan, who is Dave’s daughter.